wichita ks sales tax rate 2020

2022 Kansas state use tax. Kansas has a 65 statewide sales tax rate but also has 529 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1987 on top.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

The December 2020 total local sales tax rate was also 8500.

. Depending on local municipalities the total tax rate can be as high as 106. Local sales tax rates changes occur quarterly and are published on our website 60 days in advance see EDU-96. For a current listing of the sales tax rates visit the Kansas Department of.

Lowest sales tax 55 Highest sales tax 115 Kansas Sales Tax. There is no applicable special tax. - The Income Tax Rate for Wichita is 57.

The December 2020 total local sales tax rate was also 7500. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Between the state and local taxes the average sales tax rate in Kansas is 87 ninth-highest in the country.

Avalara provides supported pre-built integration. The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. Counties may levy a local sales tax in one-fourth percent increments 025 050 etc.

679 rows 2022 List of Kansas Local Sales Tax Rates. The Kansas sales tax rate is currently. 8201 E Harry St Wichita KS 67207 165000 MLS 614441 Welcome home to this charming townhouse.

Wichita KS Sales Tax Rate. IC1W 0 9500 601 E Douglas Avenue. TOPEKA KS 66601 -3506 PHONE.

The Kansas use tax is a special excise tax assessed on property purchased for use in Kansas in a jurisdiction where a lower or no sales tax was collected on the purchase. - Tax Rates can have a big impact when Comparing Cost of Living. 2020 rates included for use while preparing your income tax deduction.

You can print a 75 sales tax table here. - The Sales Tax Rate for Wichita is 75. Income and Salaries for Wichita.

You can print a 86 sales tax table here. The average cumulative sales tax rate in Wichita Kansas is 75. The Kansas use tax should be paid for items bought tax-free over the internet bought.

The County sales tax rate is. Average Sales Tax With Local. Cities may levy a local sales tax in five-hundredth percent increments 005.

Wichita Spaghetti Works CID. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. Tax Rates for Wichita.

Average Sales Tax With Local. The Missouri sales tax rate is currently. For tax rates in other cities see Kansas sales taxes by city and county.

The minimum combined 2022 sales tax rate for Wichita Kansas is. - The average income of a Wichita resident is 24921 a year. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

This includes the sales tax rates on the state county city and special levels. The rate ranges from 75 and 106. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

What is the sales tax rate in Wichita Kansas. The Kansas City sales tax rate is. You can print a 75 sales tax table here.

The US average is 46. 19 lower than the maximum sales tax in KS. 31 Wichita Ks Sales Tax Rate 2019.

2020 Chevrolet Equinox Lt. The state sales tax rate in Kansas is 6500. Counties are authorized to impose a maximum 1 general sales tax rate.

In the last year it was offered the refund was available to those who made less than 35401 were 55 or older. There are a total of 529 local tax jurisdictions across the state. Rates include state county and city taxes.

Shoppers in certain parts of Kansas can pay as high as 105. There is no applicable city tax or special tax. The 86 sales tax rate in Hutchinson consists of 65 Kansas state sales tax 1 Reno County sales tax and 11 Hutchinson tax.

Kansas repealed its food sales tax refund program in 2012 to help pay for tax cuts. The minimum combined 2022 sales tax rate for Kansas City Missouri is. Wichita collects the maximum legal local sales tax.

Did South Dakota v. This rate includes any state county city and local sales taxes. Other local-level tax rates in the state of Kansas are quite complex compared against local-level tax rates in other states.

The latest sales tax rate for Wichita County KS. The US average is 73. Wichita County Sales Tax Rates for 2022.

The KS use tax only applies to certain purchases. 2020 rates included for use while preparing your income tax deduction. The Kansas KS state sales tax rate is currently 65.

What is the sales tax rate in Kansas City Missouri. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Kansas KS Sales Tax Rates by City.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of. You can find more tax rates and allowances for Wichita County and Kansas in the 2022 Kansas Tax Tables. Cities are authorized to impose a maximum sales tax rate of 3 2 general and 1 special.

There is no applicable city tax or special tax. Kansas first adopted a general state sales tax in 1937 and since that time the rate has risen to 65 percent. The highest Kansas tax rate increased from 52 to 57 in 2018 up from 46 for the 2016 income tax year.

The County sales tax rate is. This is the total of state county and city sales tax rates. The Wichita sales tax rate is.

Rates include state county and city taxes. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. This is the total of state county and city sales tax rates.

Lower sales tax than 74 of Kansas localities. Sales Tax Calculator Sales Tax Table. 2020 rates included for use while preparing your income tax deduction.

For tax rates in other cities see Puerto Rico sales taxes by city and county. What is the sales tax rate in Wichita Kansas. The US average is 28555 a year.

The current total local sales tax rate in Wichita KS is 7500. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. 645 E Douglas Avenue.

The minimum combined 2022 sales tax rate for Wichita Kansas is. For tax rates in other cities see Puerto Rico sales taxes by city and county. The Wichita sales tax rate is.

With local taxes the total sales tax rate is between 6500 and 10500. Since last year mark an X in this box. 3 lower than the maximum sales tax in KS.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Kansas Sales Tax Rates By City County 2022

Texas Sales Tax Rates By City County 2022

Higher Local Sales Tax On Cannabis Weighed In Oregon Legislature Portland Business Journal

What Happens If You Don T File A Tax Return Cbs News

State Tax Revenue Eclipses Kansas Projections By 758 Million In Past Fiscal Year Kansas Reflector

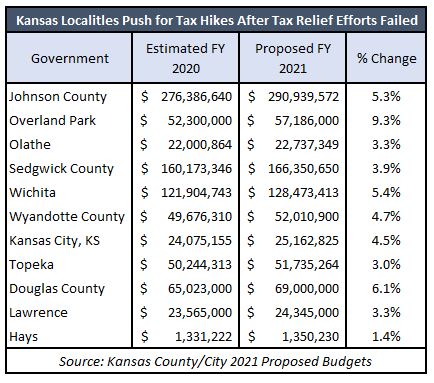

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

Lauren Fitzgerald Communications Director Office Of The Governor Kansas Linkedin

My Local Taxes Sedgwick County Kansas

Wichita Sales Tax Election Map

Legislature Take Note Eliminating Sales Tax On Food Especially Important For Older Kansans Kansas Reflector

Legislature Take Note Eliminating Sales Tax On Food Especially Important For Older Kansans Kansas Reflector

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Iata List Of Ticket And Airport Taxes And Fees

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates